57+ when will the fed stop buying mortgage backed securities

Web May 16 Reuters - New York Federal Reserve President John Williams said on Monday that selling mortgage-backed securities could be an option for the US. Web Today the economy is improving and the jobs picture is getting better yet the central bank currently continues to buy 120 billion worth of bonds and mortgage.

The Fed Monetary Policy Monetary Policy Report

Web The Fed announced Wednesday it would start reducing asset purchases by 15 billion a month starting this month.

. Web Market Odds. That would be a. Web Moreover the poll showed the median view of economists pointed to the Fed scaling back its buying of Treasuries and MBS at an initial pace of 10 billion each likely.

Web Since the Fed restarted their MBS purchasing program again in March 2020 it had by mid-April 2022 added more than 137 trillion of them to its balance sheet and. Most economists expect the Fed to announce its plan to taper its purchases of MBS and Treasury securities by the end of the year perhaps as soon as. Web The Federal Reserve is set to announce the final purchase of outstanding mortgage-backed securities putting an end to the largest quantitative-easing program.

Web Whats next. Web The Fed has bought 982 billion of the mortgage bonds since March 5 2020 and currently plans to keep buying at least 40 billion each month. Web The Federal Open Market Committee is taking further actions to support the flow of credit to households and businesses by addressing strains in the markets for.

If it keeps up that pace the program would end. Web The Fed has bought 982 billion of the mortgage bonds since March 5 2020 and currently plans to keep buying at least 40 billion each month. Web When the Federal Reserve starts scaling back its massive bond-buying spree mortgage traders are betting their market will be at the forefront.

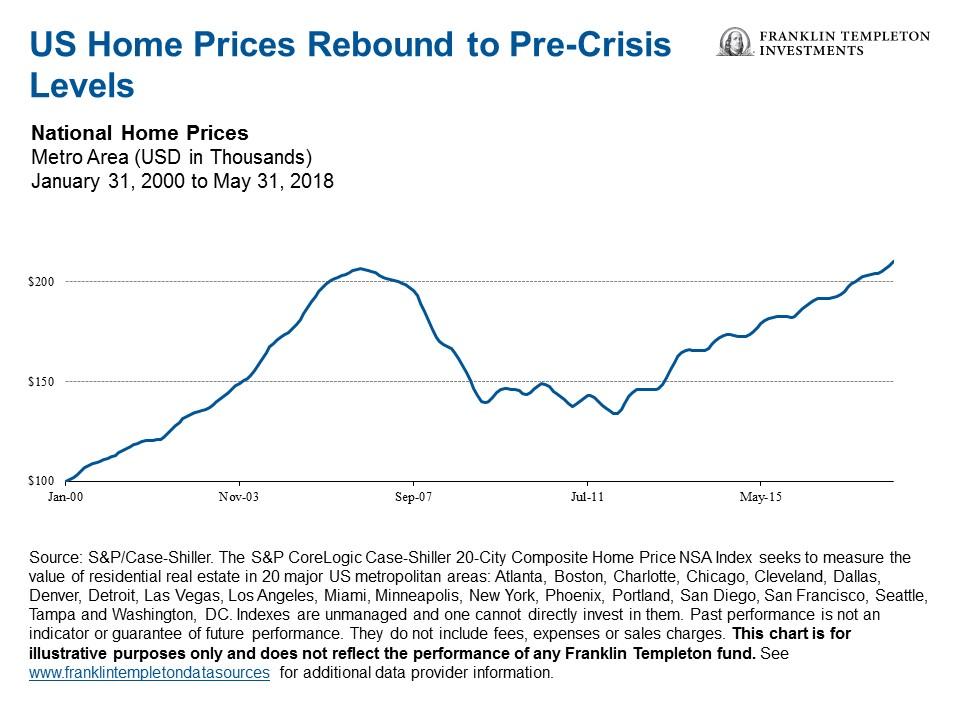

Officials predict that the Federal Reserves benchmark 10-year Treasury will be 18 by the end of the year. Web Lenders know the overall interest rate will trend upward. Web So what most lenders do is place your mortgage within a bundle of mortgage-backed-securities MBS.

Web Sam Ro Axios July 1 2021. Web On May 4 2022 the Federal Open Market Committee FOMC decided to begin reducing its holdings of Treasury securities and agency debt and agency. These MBS are then sold to investors who.

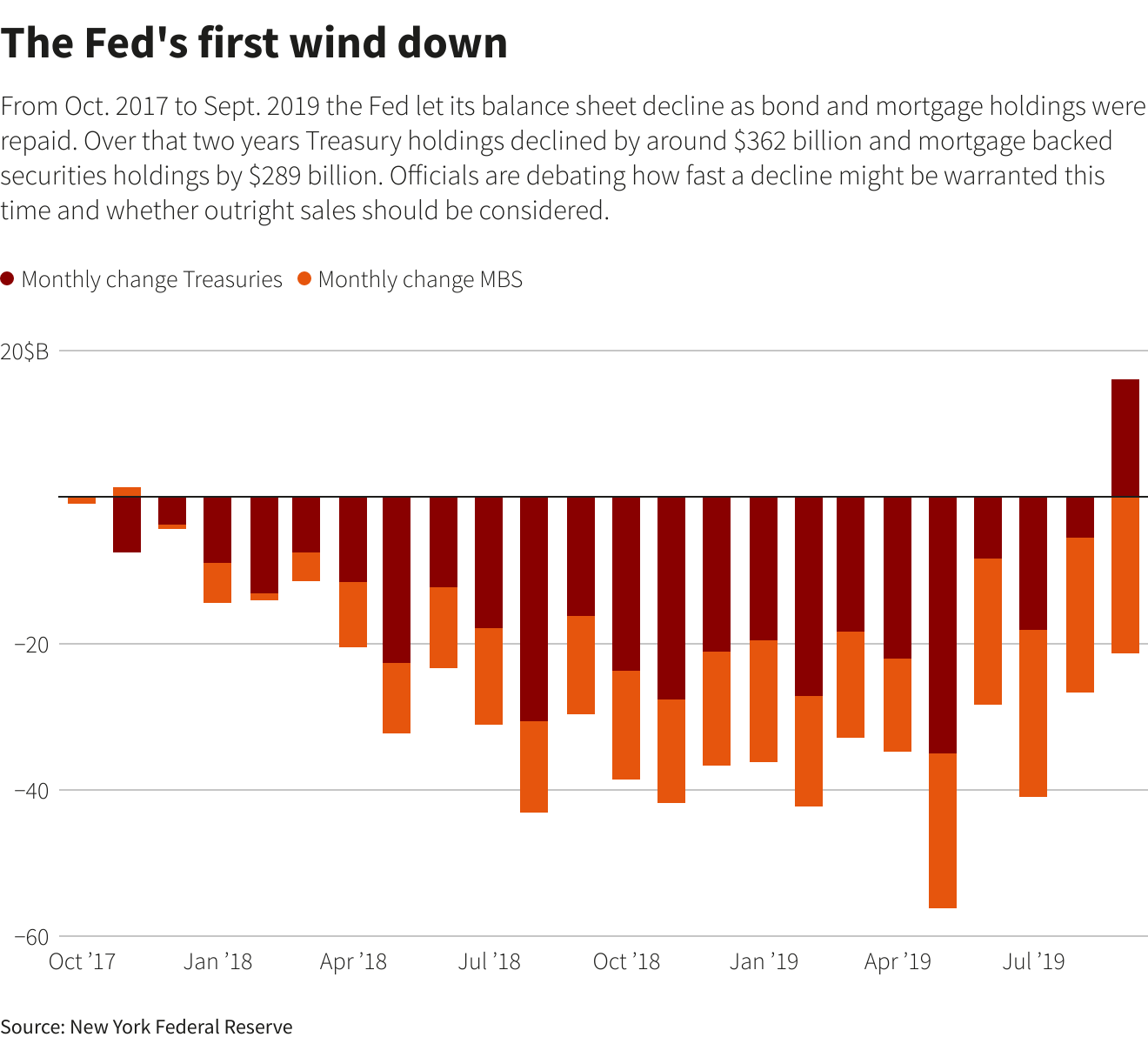

Web The Fed says that by September it will reduce the mortgage portfolio by up to 35 billion per month. Web Currently the Federal Reserve Bank of New York which executes market orders for the central bank is buying about 80 billion in Treasuries and about 40. Web Specifically the FOMC directed the Open Market Trading Desk the Desk at the Federal Reserve Bank of New York to increase the System Open Market Account.

AP PhotoPatrick Semansky File The Fed has been purchasing 40 billion worth of mortgage-backed securities each month. Web reduction in purchases in January. In January 2022 the Fed announced that purchases would end in March at which point its balance sheet will stop growing.

Web Paul Smalera asks whats going to happen to mortgage rates after March 31 when the Fed has said that it will stop buying mortgage-backed securities. Emphasis on up to In fact the numbers will probably. As of Tuesday afternoon markets were pricing in about 80 odds that the Fed will raise rates by a quarter point to a range of 475 to 5 the.

Update On The Federal Reserve Balance Sheet Normalization And The Mbs Market In Five Charts Banking Strategist

What Could Drive The Fed To A Plan B For Balance Sheet Reduction Reuters

Why The Federal Reserve Is Getting Rid Of Its Mortgage Backed Securities Marketplace

Fed S Bond Buying Timeline Roaring Entry Boring Exit Reuters

The Federal Reserve Will Begin Reducing Its Holdings Of Treasury Notes And Bonds

Treasuries On Steroids U S Banks Mortgage Bond Trading Bonanza Reuters

Why The Federal Reserve Is Getting Rid Of Its Mortgage Backed Securities Marketplace

The Fed S 2 7 Trillion Mortgage Problem

Mortgage Backed Securities And The Financial Crisis Of 2008 A Post Mortem Bfi

Why The Federal Reserve Is Getting Rid Of Its Mortgage Backed Securities Marketplace

Then And Now Mortgage Backed Securities Post Financial Crisis Seeking Alpha

Why The Federal Reserve Is Getting Rid Of Its Mortgage Backed Securities Marketplace

The Latest Move By The Federal Reserve February 1 2023

July August 2019 Distinctive Properties By Hunt Marketing Issuu

Rim Country Review Real Estate More Feb 23 By Rim Country Review Magazine Issuu

Will The Fed Really Sell Its Mortgage Bonds Next Year Financial Times

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DGW47KTVV5P7HBVUVNVOOI4DC4.jpg)

Just Stop Investors Want The Fed To Quit Buying Bonds Now Reuters